Content

An owner’s draw is a distribution of profits to the owner or shareholder. While owner’s draw can provide flexibility and tax advantages, it’s important to ensure that the owner is still receiving reasonable compensation for their services to the company. An owners draw is a money draw out to an owner from their business.

Owner’s Draw vs Salary: What is an Owner’s Draw? – Nav

Owner’s Draw vs Salary: What is an Owner’s Draw?.

Posted: Tue, 16 Jun 2020 07:00:00 GMT [source]

Similarly, single-member LLCs are like sole proprietors and draw funds from businesses. However, multi-member LLC is treated like a partnership firm where profits and losses are distributed among members. Salaries are part of the payroll process because they’re subject to payroll taxes. Salary and payroll tax expenses are an allowable business expense, reducing your company’s net income. While your employees get paid every time you do payroll, you don’t have to take an owner’s draw at regular intervals. As a business owner, if you receive a salary then you will receive fixed-amount payments on a regular basis just like an employee.

What is an Owners Draw vs Payroll When I Pay Myself As A Business Owner?

This includes when to take profits out of the business and how much to take. As an owner, you can take owner distributions — and tap into the business profits for your personal gain — whenever you deem appropriate. If your business structure is any other than a C corporation, you may take an owner’s draw if you own equity in the business. The reason is that pass-through entities show profits on your personal taxes. An owner’s draw requires more personal tax planning, including quarterly tax estimates and self-employment taxes. The draw itself does not have any effect on tax, but draws are a distribution of income that will be allocated to the business owner and taxed.

The cash drawn out of the business bank account should be taken out of the profits after all business expenses are paid. It’s not a salary in the technical sense, but more of the owner’s equity in the business. Keep good financial records, recording each equity distribution in your accounting software so that, at the end of the year, it’s easy to file your personal income taxes. How to pay yourself as a business owner depends upon the business structure and payment method. The owners of sole proprietorships, partnerships, and LLCs are considered self-employed. Hence, they receive the owner’s draw and do not pay themselves regular wages.

What is Owner’s Draw?

If you take a draw, you may be responsible for making quarterly estimated tax payments as well depending on what you’ll expect to owe in taxes for the year. Once, you have decided your payroll schedule, you can pay yourself by either writing a check and depositing the same into your bank account. Finally, the rules about the owner’s draw in the case of an LLC vary depending upon laws. Hence, you need to go through the laws before considering the owner’s draw and taxes on the same in the case of an LLC. However, in the case of partnerships, a single person does not have a claim on the revenue or profits of the business.

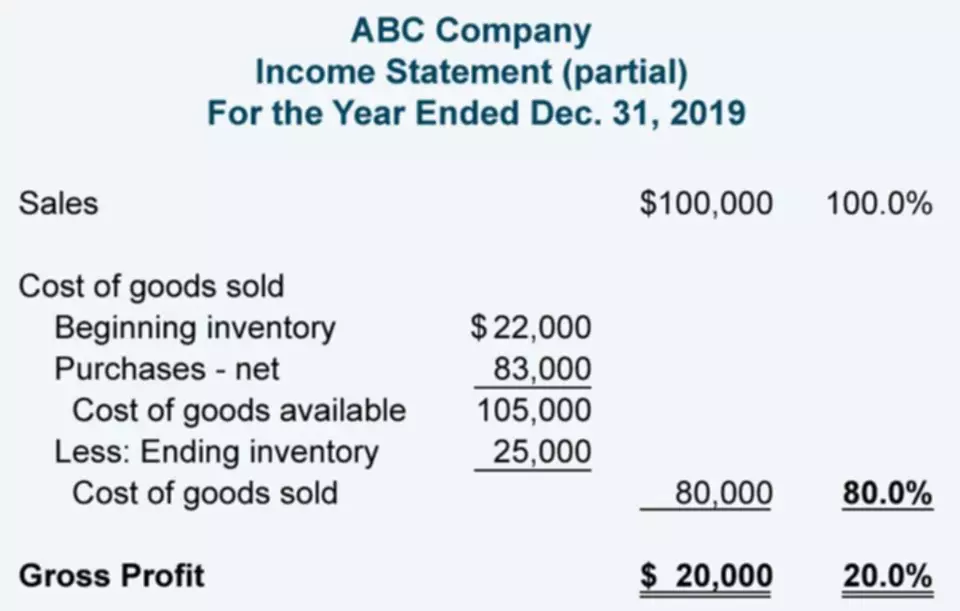

Does owner’s draw show up on profit and loss?

Answer and Explanation: No, the owner's draw does not go on a profit and loss statement since it is not a business expense. The owner's drawings are not reported on the profit and loss accounts so that the owner cannot mistakenly claim tax relief on them.

Once you’ve reached a break-even point in the business, it’s a good idea to correlate any salary increases (or bonuses) to the performance of the business. The best method for you depends on the structure of your business and how involved you are in running the company. Your equity is defined as the amount of accumulated value you’ve invested into the business through things like cash, equipment, and other assets. When you’re evaluating the best method to pay yourself, there are several factors to consider.

Owner’s draw in an S corp

Therefore, each partner includes his share of income in his income tax return. Furthermore, he is required to pay income tax and self-employment taxes quarterly. Say a sole proprietorship that opened last year earned $100,000 and had $300,000 in cash. The sole proprietor can receive a dividend distribution of up to $100,000. To access more cash, the sole proprietor would take an owner’s draw.

On the other hand, owners of corporations or S-corporations generally can’t take a draw and would typically be paid a salary instead. Just remember that if you own an S-corporations, your salary must be considered reasonable compensation, which we’ll discuss in a bit. The two most common https://www.bookstime.com/articles/owners-draw-vs-salary ways for business owners to get paid is to either take an owner’s draw or receive a salary. Owner’s equity refers to the right of the business owners on the company’s assets. In other words, it is the portion of the company’s assets that the owners and its shareholders can claim.

Accounting for owner’s draws

No taxes are withheld from the check since an owner’s draw is considered a removal of profits and not personal income. While it may sound ideal to have easy access to business funds whenever you choose, taking an owner’s draw isn’t the only way to get income from your business. Owners can also opt to take a regular salary instead of or in addition to an owners draw, and each method comes with certain tax implications for both the owner and the business.

If you choose to take a salary, consult with your bookkeeper to ensure it is in line with reasonable compensation for your industry and position. No matter if you choose a draw or salary–or a combination of both– ensure that you pay yourself fairly and what your business can afford. According to the IRS, compensation to owners (regardless if it’s an owner’s draw or salary) must be reasonable. This can mean different things to different people, but essentially you should take out what is needed to cover your expenses and what your business can afford. This means tracking income and expenses will be simpler and any bonuses in the good months will be taxed.

Steps to Paying Yourself With an Owner’s Draw

Your financial situation can also impact your decision to take a salary or an owner’s draw. If you need a steady income to pay private bills, a salary may be a better option. If you have more flexibility in your finances, an owner’s draw may provide more financial benefits.

- In the case of an LLC or a corporation, the owner’s equity may be termed as shareholders’ equity or stockholders’ equity.

- For completeness, profit distributions made by S corporations are, technically, different from dividends.

- This isn’t a simple choice of do you want to pay yourself or just compensate yourself.

- Owner’s draws, also known as “personal draws” or “draws,” allow business owners to withdraw money as needed and as profit allows.

- Accordingly, you are also not subject to pay any self-employment taxes.

We’re here to help, and we’d be more than happy to sit down and have a chinwag about your small business and what your best foot forward might be. When you launch a small business or startup, you may not have enough revenue to pay yourself for the first year or two. Do you have other questions about your business, such as EIDL applications, SBA loans, or other business funding questions? There are over 3,500 on our waiting list, but you can skip the waitlist completely with this invite link. Offer health, dental, vision and more to recruit & retain employees. If you are looking to outsource Paychex can help you manage HR, payroll, benefits, and more from our industry leading all-in-one solution.

Whether you’d prefer to take drawings from your business or jump straight to a salary, it’s important to get a better understanding of what all that actually means, too. Any personal draw out will decrease your cash assets because you are taking capital out. You don’t want to risk insolvency, so be sure to take only what is essential. An accountant will help you understand how much you can take from the business and meet investment goals.

Many legal factors go into choosing whether to take an owner’s draw or a salary. However, the type of income you make from your company is highly dependent on your business tax structure. There are five common business structures, and each one influences the way small business owners pay themselves. A salary, on the other hand, is a set, recurring payment that you’ll receive every pay period that includes payroll tax withholdings. When deciding what to pay yourself, you’ll want to take into account your expected profit and expenses.

The Owner’s Draw Method

There’s no one formula as businesses vary in industry, size and structure. In business, there are pros and cons to every decision, and that’s especially true when determining how to pay yourself as a business owner. The advantage of a draw is flexibility based on how great the business is https://www.bookstime.com/ performing. Consult a tax professional if you are unsure of the best way to pay yourself. An owner’s draw can be uncertain as it depends on the company’s profitability and cash flow. If the company’s revenue decreases, there may not be enough money available for the owner to take a draw.

What is a draw when it comes to salary?

A draw is an advance against future anticipated incentive compensation (commission) earnings. This form of payment is a slightly different tactic from one where an employee is given a base pay plus commission.